Guru Purnima is a time to pause and express gratitude for the mentors who guide us—whether in life, learning, or wealth. In the realm of money, too, we all need gurus. Be it through books, financial advisors, or seasoned professionals, the pursuit of financial wisdom begins with humility and a willingness to learn.

As financial literacy grows in importance, more individuals are realising that financial education is not just about filing taxes or picking the right mutual fund. It’s about understanding risk, cultivating patience, and making informed decisions across decades. That’s where the guidance of a financial expert—or a financial ‘guru’—can transform how we view and manage money.

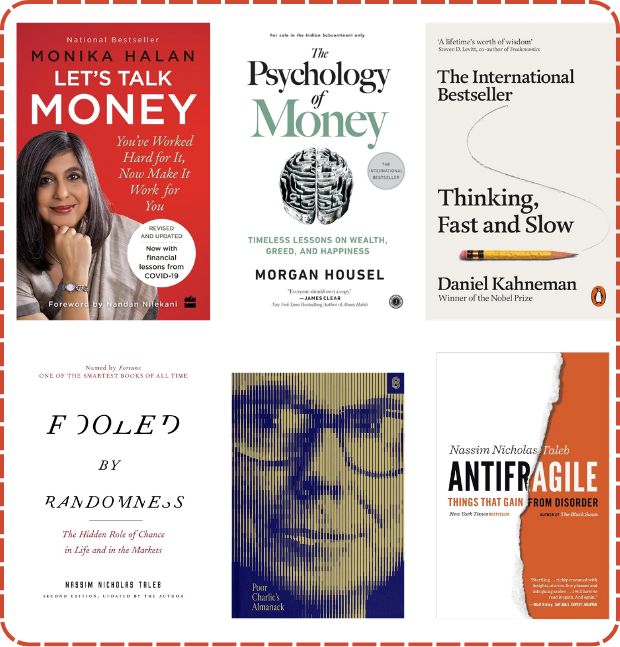

For beginners, books like “Let’s Talk Money” by Monika Halan or “The Psychology of Money” by Morgan Housel offer excellent starting points. But if you’re an advanced investor, you might enjoy titles that go beyond personal finance, such as:

- “Thinking, Fast and Slow” by Daniel Kahneman – a deep dive into cognitive biases that affect investment decisions.

- “Fooled by Randomness” by Nassim Nicholas Taleb – explores how luck, probability, and uncertainty impact financial outcomes.

- “Poor Charlie’s Almanack” by Charles T. Munger – a compilation of worldly wisdom from one of the most disciplined investors.

- “Antifragile” by Taleb – ideal for those thinking beyond resilience and toward strategies that thrive under stress.

And of course, one must not overlook the real-life gurus—financial advisors—who offer personalised wealth management tips, portfolio reviews, and strategic guidance aligned with your financial goals.

Financial wisdom is not a milestone—it’s a lifelong practice. This Guru Purnima, honour the teachers who shape your financial journey, and continue investing in the one asset that grows with age: your knowledge.